Oakland Organizations Champion Financial Literacy Empowering Residents with Vital Resources

By Magaly Muñoz

Rising numbers of unbanked or underbanked individuals, largely due to unmet minimum balance requirements, have become a growing concern. However, organizations across Oakland are stepping up, waging a war against the financial illiteracy that’s plaguing some residents.

Up to 4% of Alameda County’s residents lack access to basic banking services, with Black and Hispanic communities making up the majority of that unbanked or underbanked population. The term ‘unbanked’ describes people without a checking or savings account, while ‘underbanked’ describes people who have checking or savings accounts but often rely on alternative financial solutions like money orders and payday loans rather than conventional loans and credit cards.

Recently, the downtown Oakland Wells Fargo branch redesigned their bank to include a Hope Inside center in partnership with Operation HOPE, an organization centered around expanding economic opportunities for underserved communities.

The center features free access to financial coaches who work with individuals to gain financial assistance and guidance, such as helping improve credit scores.

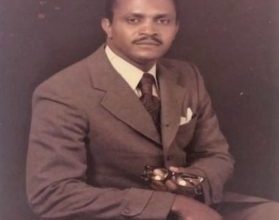

Dr. Joaquin Wallace is one of the financial coaches at the Oakland branch who meets one-on-one with clients to provide credit money management solutions and develop strategic plans to assist them with reaching their financial goals.

He’s created a seven-step blueprint for attaining generational wealth. This includes acknowledging that your background and culture have significant influence on how you view finances, focusing on reprogramming financial trauma and gaining financial edification through literacy programs.

He shared that it can be difficult for some to accept their financial struggles because their environment might not allow for these immediate understandings because for many, money is not openly discussed in their communities.

“Money is a topic that is not communicated about — it’s taboo. And so first, you have to at least feel comfortable enough to have this conversation,” Wallace said.

Despite the initial roadblocks, the branch is seeing success with the program. Fifty-seven percent of the clients at the Hope Inside center have increased their credit score by an average of 19 points; 47% of the clients increased their savings by a median of $141; and 50% of clients have successfully reduced their debt by a median of $364.

Sonya Verdine, an Oakland resident of four years, is one of the success stories that Oakland Wells Fargo has helped since their soft launch in 2022.

Verdine’s life has been a rollercoaster of challenges including homelessness, mental health struggles and health scares that ultimately pushed her to improve her life, starting with attempting to correct the financial choices she’d made up to that point.

She was introduced to Wallace’s seven-step generational wealth method which provided her with a roadmap to get her on the right track to financial stability. Since visiting the Hope Inside center, Verdine has seen her credit score go up 200 points and she’s saving almost 10% of her income every month with a goal to someday buy her own home.

“You can take this program, you can start from literally nothing, and the program can help you build because they offer a variety of other services,” Verdine said. “It will be time well spent to participate in this program.”

Another organization that has long taken the reins to combat financial illiteracy and break the cycle of poverty is United Way Bay Area (UWBA), a program that assists families in the region to find financial stability.

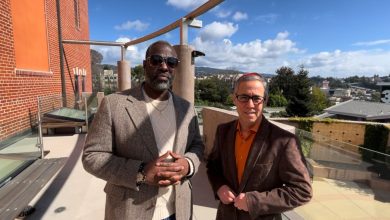

Nicole Harden, Vice President of Economic Success at UWBA, says that their Sparkpoint program, which features centers scattered across the Bay Area that help low to middle income families establish financial goals, has grown tremendously since its inception in 2009. Anyone can come into one of their 23 centers to consult with a financial coach to receive guidance on how to increase their income, boost their credit, augment their savings, or reduce their debt.

She shared that it’s important for people to not feel embarrassed when talking about their financial struggles. Organizations like UWBA exist to help provide resources that they know are often inaccessible to underserved communities.

Harden explained that their centers not only cater to low-income families but see a significant number of women of color seeking assistance. As a result, they’ve taken the steps to ensure their programs are culturally competent to make conversations easier and more comfortable.

“We operate from the assumption that folks are creative, resourceful and whole. People have been making it all along, people aren’t broken. There’s systems that are broken, but this is an opportunity to work within the systems and help folks figure out how to navigate that,” she said.